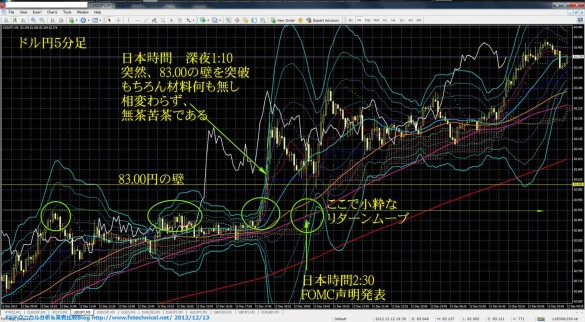

日本時間 2012/12/13 (木) 02:30ごろ発表

Release Date: December 12, 2012

For immediate release

Information received since the Federal Open Market Committee met in October suggests that economic activity and employment have continued to expand at a moderate pace in recent months, apart from weather-related disruptions. Although the unemployment rate has declined somewhat since the summer, it remains elevated. Household spending has continued to advance, and the housing sector has shown further signs of improvement, but growth in business fixed investment has slowed. Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee remains concerned that, without sufficient policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will purchase longer-term Treasury securities after its program to extend the average maturity of its holdings of Treasury securities is completed at the end of the year, initially at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and, in January, will resume rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent(失業率6.5%を超えるうちは異例の低金利が適切である), inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal(向こう1年から2年の間のインフレ率が、委員会の長期的目標である2%を0.5%上回ると予測されないうちは、異例の低金利が適切である), and longer-term inflation expectations continue to be well anchored.(そしてより長期的なインフレ予測がしっかりと安定的であり続けるうちは、異例の低金利が適切である) The Committee views these thresholds as consistent with its earlier date-based guidance. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed the asset purchase program and the characterization of the conditions under which an exceptionally low range for the federal funds rate will be appropriate.(いつものおじちゃんが反対)

市場予想どおりの実質ゼロ金利据え置きでしたが、

まず、QE3の実施規模縮小、

そしてなんと、

「異例の低金利」の具体的な解除条件が三つ飛び出してきました!

・失業率6.5%以下になること

・1~2年先のインフレ率予測が2.5%を超えること

・より長期的な(3年以上先の)インフレ予測が、上振れの恐れがあること

以上の三つの条件をクリアすれば、

徐々に金利を上げていく、ということのようです。

今までは2015年半ばまで異例の低金利を続ける!と言ってきたわけですが、

突如スタンスが変わってきました。

面白いことになってきました。

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは19:30が日本時間02:30

政策金利一覧