FOMC声明 日本時間 2016/03/17 (木) 03:00発表

Press Release

Release Date: March 16, 2016

For release at 2:00 p.m. EDT

Information received since the Federal Open Market Committee met in January suggests that economic activity has been expanding at a moderate pace despite the global economic and financial developments of recent months. Household spending has been increasing at a moderate rate, and the housing sector has improved further; however, business fixed investment and net exports have been soft. A range of recent indicators, including strong job gains, points to additional strengthening of the labor market. Inflation picked up in recent months; however, it continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. However, global economic and financial developments continue to pose risks. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee continues to monitor inflation developments closely.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. (金利据え置き)The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action was Esther L. George, who preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.(0.5~0.75%への追加利上げを主張)

FRB: Press Release--Federal Reserve issues FOMC statement--March 16, 2016

http://www.federalreserve.gov/newsevents/press/monetary/20160316a.htm

日本時間3:30ごろから、 イエレン会見 開始

「コアインフレの上昇が持続的かまだ不明。」

「利上げ見送りは経済見通しと先行きリスクを反映。」

「見通しは12月から大きく変わっていない。労働市場はなお改善の余地。賃金はまだ持続的な上昇示さず。これまでのエネルギー安・ドル高がインフレの重しになる可能性。」

「利上げの軌道修正は世界経済の見通しを反映。クレジット状況も一部反映。」

「最近のインフレ指標の上昇は一時要因の可能性。」

「4月会合は予断を持たず。常に政策変更の可能性ある。」

FOMC声明については、

市場予想どおり、今回は金利据え置きとなりました。

内容については、本文中で世界経済の下向きリスクを何度も指摘しており、

利上げイケイケという感じは無く、慎重な姿勢が見られます。

その一方で、追加利上げを主張する委員が1名おり、

悪材料とも好材料とも、どちらとも言えない内容になりました。

その後のイエレン会見では、

どちらかというと重い内容で、利上げ姿勢はかなり後退した印象を受ける内容でした。

ただ、グローバル的な状況を見ると、

経済ボロボロで貨幣をジャブジャブ刷って刷って刷りまくり(&戦争の気配)の欧州、日本と比較すると、

相対的には、米国一人勝ちの様相です。

ファンダメンタル分析的に考えれば、

FOMC声明で多少乱高下しつつも、

結局米国しかまともなとこないじゃん、となり、じわりとドル高になる

と考えるのが自然です。

少なくとも、ドル安になる材料ではないように思えます。

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは14:00が日本時間03:00

株 爆上げ

ドル 迷いなく一直線の暴落

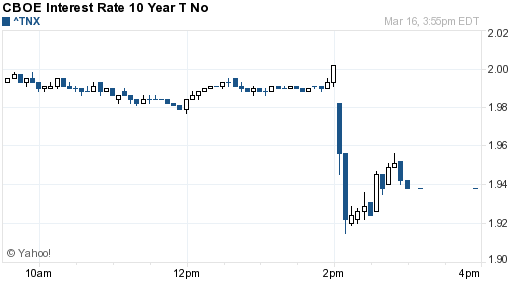

米長期金利(米国債10年物流通利回り) →金利爆下げ

→ http://fxtechnicalblog.fxtec.info/2006/12/saxo_1.html

各国政策金利一覧