FOMC声明 日本時間 2016/01/28 (木) 04:00発表

Press Release

Release Date: January 27, 2016

For release at 2:00 p.m. EST

Information received since the Federal Open Market Committee met in December suggests that labor market conditions improved further even as economic growth slowed late last year. Household spending and business fixed investment have been increasing at moderate rates in recent months, and the housing sector has improved further; however, net exports have been soft and inventory investment slowed. A range of recent labor market indicators, including strong job gains, points to some additional decline in underutilization of labor resources. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation declined further; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. Inflation is expected to remain low in the near term, in part because of the further declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook.

Given the economic outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent.(金利据え置き) The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Esther L. George; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo.(全会一致)

FRB: Press Release--Federal Reserve issues FOMC statement--January 27, 2016

http://www.federalreserve.gov/newsevents/press/monetary/20160127a.htm

今回は イエレン会見 無し

市場予想どおり、今回は金利据え置きとなりました。(前回12月は利上げ)

特にサプライズもありません。

ただ、グローバル的な状況を見ると、

経済ボロボロで、貨幣をジャブジャブ刷って刷って刷りまくり(&戦争の気配)の欧州、日本と比較すると、相対的には、米国一人勝ちの様相です。

ファンダメンタル分析的に考えれば、

結局米国しかまともなとこないじゃん、となり、じわりとドル高になる

と考えるのが自然です。

少なくとも、ドル安になる材料ではないように思えます。

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは14:00が日本時間04:00

株 暴落

ドル 暴落

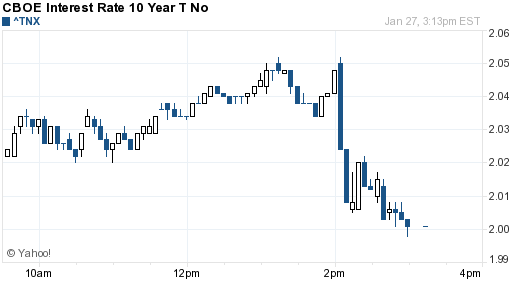

米長期金利(米国債10年物流通利回り) →金利低下

→ http://fxtechnicalblog.fxtec.info/2006/12/saxo_1.html

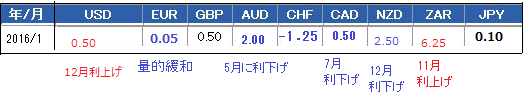

各国政策金利一覧