FOMC声明 日本時間 2014/12/18 (木) 04:00ごろ発表

Press Release

Release Date: December 17, 2014

For immediate release

Information received since the Federal Open Market Committee met in October suggests that economic activity is expanding at a moderate pace. Labor market conditions improved further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices. Market-based measures of inflation compensation have declined somewhat further; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators moving toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for economic activity and the labor market as nearly balanced. The Committee expects inflation to rise gradually toward 2 percent as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. (金利据え置き) In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. (it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time から文言変更) The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored. However, if incoming information indicates faster progress toward the Committee's employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; and Daniel K. Tarullo.

Voting against the action were Richard W. Fisher, who believed that, while the Committee should be patient in beginning to normalize monetary policy, improvement in the U.S. economic performance since October has moved forward, further than the majority of the Committee envisions, the date when it will likely be appropriate to increase the federal funds rate; Narayana Kocherlakota, who believed that the Committee's decision, in the context of ongoing low inflation and falling market-based measures of longer-term inflation expectations, created undue downside risk to the credibility of the 2 percent inflation target; and Charles I. Plosser, who believed that the statement should not stress the importance of the passage of time as a key element of its forward guidance and, given the improvement in economic conditions, should not emphasize the consistency of the current forward guidance with previous statements. (反対三名。利上げに慎重。)

FRB: Press Release--Federal Reserve issues FOMC statement--December 17, 2014

その後、日本時間4:30ごろからイエレン会見

「フォワードガイダンスの修正は意向の変化意味せず。経済の進展による。」

「雇用の伸びはこれまで力強い。」

「原油価格の下落は短期的にインフレを押し下げる。現時点では低下は一時的と判断。市場ベースのインフレ期待の低下に注意払う。」

「少なくとも今後数回のFOMC会合では正常化開始する公算小さい。」

「今後数回とは2回を意味。」

「利上げが適切となる経済状況を注視。」

「参加者のほとんど、2015年利上げを想定。」

「2015年半ばの利上げ開始は指標次第。」

「一部は2015年半ばの利上げ開始予想。ただ、様々見方がある。」

「原油下落は差し引きでポジティブ。」

「世界の動向を非常に注視。」

前回のFOMCではQE3終了が宣言され、ドルのジャブジャブ供給は終わりました。

今回のFOMCでは、金利自体はゼロ金利据え置きとなりましたが、

問題は、いつゼロ金利解除するのか、利上げに踏み切るのか、です。

この点、FOMC声明を読むと、

もう利上げのタイミングを伺う準備段階に入っているのが分かる一方で、

利上げに極めて慎重なメンバーが3名いるなど、

混沌とした状況にあるようです。

その後のイエレン会見では、イエレン自身はかなり強気であり、前向きな姿勢がうかがえました。

本当に利上げはもうすぐ、という印象です。

完全に目線は利上げ方向です。

出口に向かってラストスパート!という感になってきました。

ファンダメンタル分析的に考えれば、

・いよいよ利上げ準備を臭わせる→ドル高、株安

と考えるのが自然です。

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは21:00が日本時間04:00

NYダウ乱高下の後上昇。ドル乱高下を経てドル高へ。原油さらに暴落。

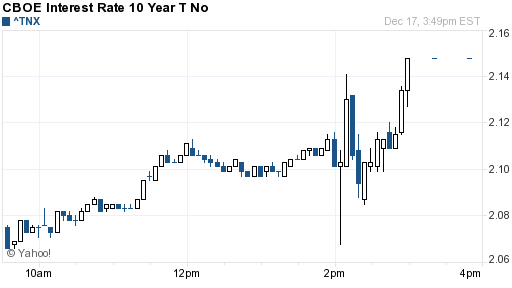

米長期金利(米国債10年物流通利回り): →微増

→ http://fxtechnicalblog.fxtec.info/2006/12/saxo_1.html

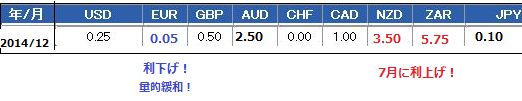

各国政策金利一覧