FOMC声明 日本時間 2013/3/21 (木) 03:00ごろ発表

Press Release

Release Date: March 20, 2013

For immediate release

Information received since the Federal Open Market Committee met in January suggests a return to moderate economic growth following a pause late last year. Labor market conditions have shown signs of improvement in recent months but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy has become somewhat more restrictive. Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will proceed at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee continues to see downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. (QE3実施規模は維持) The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Charles L. Evans; Jerome H. Powell; Sarah Bloom Raskin; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.

FRB: Press Release--Federal Reserve issues FOMC statement--March 20, 2013

http://www.federalreserve.gov/newsevents/press/monetary/20130320a.htm

3:00 FOMC Economic Projections 発表

失業率見通し:

2013年 7.3-7.5%(従来7.4-7.7%)下方修正(改善方向)

2014年 6.7-7.0%(従来6.8-7.3%)

2015年 6.0-6.5%(従来6.0-6.6%)

成長率見通し:

2013年 2.3-2.8%(従来2.3-3.0%)下方修正

2014年 2.9-3.4%(従来3.0-3.5%)

2015年 2.9-3.7%(従来3.0-3.7%)

インフレ率(PCE)見通し:

2013年 1.3-1.7%(従来1.3-2.0%)下方修正(沈静化方向)

2014年 1.5-2.0%(従来1.5-2.0%)

2015年 1.7-2.0%(従来1.7-2.0%)

.

3:30ごろ バーナンキ議長会見

「穏やかな成長に戻っている」

「失業率は依然として高い」

「住宅市場はさらに伸びている。」

「民間雇用市場の成長はさらに急速。」

「インフレ見通しは安定的。」

「FOMCで資産購入のリスクについても議論した」

「資産購入の終了から利上げまでにかなりの時間的な隔たり。」

「緩和規模調整のため資産買い入れペースを月ごとに調整する可能性。」(QE3終了への布石)

「失業率基準のさらなる引き下げ、刺激策への一手段となる可能性。」(利上げ先延ばし方向)

「過度に力強い成長予想していない、FOMC失業率見通しは昨年9月から著しく改善。」

市場予想どおりの実質ゼロ金利据え置き、

QE3実施規模の据え置き、

「異例の低金利」の具体的な解除条件据え置き、

と、おおむね予想どおりの結果となりましたが、

「ハイレベルの金融緩和を続けると、将来の不均衡リスク、長期的インフレ期待を招く」という趣旨の、

引き締め方向の意見も出たようです。

また、FOMC経済見通しでは、

失業率は改善方向での見通し修正、

成長率はやや下方修正

インフレは沈静化方向での見直しとなりました。

労働環境は予想以上の改善、

ただし、景気、インフレは思ったほどではない、

ということのようです。

また、バーナンキ会見では、

経済見通しについていくぶん楽観的な雰囲気が出てきたようで、

希望の光が見えてきたような感じです。

量的緩和QE3(要するにドルをジャブジャブ刷りまくり)についても、出口が見えてきました。

悪くない内容です。

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは20:00が日本時間03:00

乱高下の後、ドル買い勢力の押し勝ちとなりました。

ただ、NYダウは決して強気ムードでは無く、

米長期金利もイケイケムードではありません。

盛り上がっているのは円安相場だけ、という感があります。

何が何でも円安にしたいおじちゃんたちがいるようです。

チキンレース的な空気を感じます。

3月末にかけて、壮大な仕掛けありそうです。

ご注意ください。

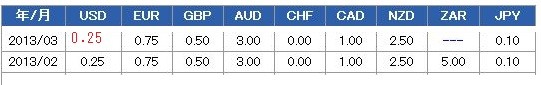

政策金利一覧