日本時間2011/08/10 03:15発表

Press Release

Release Date: August 9, 2011

For immediate release

Information received since the Federal Open Market Committee met in June indicates that economic growth so far this year has been considerably slower than the Committee had expected. Indicators suggest a deterioration in overall labor market conditions in recent months, and the unemployment rate has moved up. Household spending has flattened out, investment in nonresidential structures is still weak, and the housing sector remains depressed. However, business investment in equipment and software continues to expand. Temporary factors, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan, appear to account for only some of the recent weakness in economic activity. Inflation picked up earlier in the year, mainly reflecting higher prices for some commodities and imported goods, as well as the supply chain disruptions. More recently, inflation has moderated as prices of energy and some commodities have declined from their earlier peaks. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee now expects a somewhat slower pace of recovery over coming quarters than it did at the time of the previous meeting and anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, downside risks to the economic outlook have increased. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate further. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rateat least through mid-2013. The Committee also will maintain its existing policy of reinvesting principal payments from its securities holdings. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ these tools as appropriate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.

Voting against the action were: Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser, who would have preferred to continue to describe economic conditions as likely to warrant exceptionally low levels for the federal funds rate for an extended period.(これが従来の表記)

FRB: Press Release--FOMC statement--August 9, 2011

市場予想どおりの実質ゼロ金利据え置きでした。

が、声明文で、なんと

2013年半ばまで、金利を異例の低水準に据え置く!

ことが明記されました。

この点について、FOMCメンバーのうち3名が反対したようです。

常識的、ファンダメンタル分析的に考えると、

・株 乱高下ののち、もとの水準に(株では利下げは好材料、利上げは悪材料なのが定石)

・ドル 大暴落

となるのが自然に思えます。

では、この材料を受けて、机上の空論ならぬ現実のマーケットはどのように動いたのでしょうか?

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは20:15が日本時間03:15

ファンダメンタル分析では理解不能なメチャクチャな値動きとなりました。

特にスイスフランがメチャクチャで、

どさくさに紛れて対ユーロでもなんとパリティ(等価)寸前まで行ってしまいました。

米ドルの材料なのに、スイスフランが対ユーロでも爆裂高騰という、

意味のよくわからない現象ですが、

これが生きた相場なのです。

とりあえず、2013年半ばまでの低金利宣言が出たことで、

米長期金利(米10年国債流通利回り)は2.1730%という、歴史的低水準まで爆下げとなりました。

http://fxtechnicalblog.fxtec.info/2006/12/saxo_1.html

米ドルの末期ガン告知のようなものですが、今後世界はどうなるのでしょうか。

常識的に考えると、

ドルキャリー再開で、豪ドル、ユーロなどに資金が流れそうに思えますが、

どうなのでしょうか。

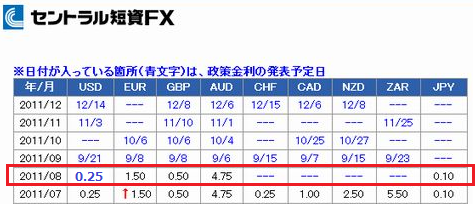

※各国政策金利一覧

データ by セントラル短資