Press Release

Release Date: June 23, 2010

For immediate release

Information received since the Federal Open Market Committee met in April suggests that the economic recovery is proceeding and that the labor market is improving gradually. Household spending is increasing but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad. Bank lending has continued to contract in recent months. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be moderate for a time.

Prices of energy and other commodities have declined somewhat in recent months, and underlying inflation has trended lower. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer-run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly.(ホーニッグ・米カンザスシティー連銀総裁反対意見)

FRB: Press Release--FOMC statement--June 23, 2010

http://www.federalreserve.gov/newsevents/press/monetary/20100623a.htm

市場予想どおりの実質ゼロ金利据え置きでした。

また、従来通り、「長期間に渡って政策金利を異例の低水準で据え置く」の文言がしっかりと明記されました。

(continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.)

何のサプライズもありません。

常識的ファンダメンタル分析的に考えると、

織り込み済みとなって動きようがないようにも思えます。

では、机上の空論ならぬ、現実のマーケットはどのように反応したのでしょうか。

以下のチャートを見る前に1分間、値動きを想像してみてください。

・NYダウ

・ドル円

・ユーロドル

・ユーロ円

・原油

・金

1分足 以下のチャートでは20:15が日本時間3:15 元気に乱高下。何も織り込まれていませんでした。

5分足 純然たるドル安

純然たるドル安で反応しました。

今の地合いがそのまま出ている模様です。

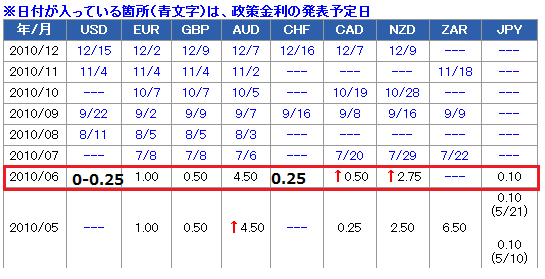

※各国政策金利一覧

データ by セントラル短資