Release Date: November 4, 2009

For immediate release

Information received since the Federal Open Market Committee met in September suggests that economic activity has continued to pick up. Conditions in financial markets were roughly unchanged, on balance, over the intermeeting period. Activity in the housing sector has increased over recent months. Household spending appears to be expanding but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment and staffing, though at a slower pace; they continue to make progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will support a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability.

With substantial resource slack likely to continue to dampen cost pressures and with longer-term inflation expectations stable, the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will continue to employ a wide range of tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. The amount of agency debt purchases, while somewhat less than the previously announced maximum of $200 billion, is consistent with the recent path of purchases and reflects the limited availability of agency debt. In order to promote a smooth transition in markets, the Committee will gradually slow the pace of its purchases of both agency debt and agency mortgage-backed securities and anticipates that these transactions will be executed by the end of the first quarter of 2010. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

FRB: Press Release--FOMC statement--November 4, 2009

http://www.federalreserve.gov/newsevents/press/monetary/20091104a.htm

市場予想どおりの実質ゼロ金利据え置きでした。

では、机上の空論ならぬ、現実のマーケットはどのように反応したのでしょうか。

以下のチャートを見る前に1分間、値動きを想像してみてください。

・NYダウ

・ドル円

・ユーロドル

・ユーロ円

・原油

・金

5分足 以下のチャートでは4日20:15が日本時間5日4:15

15分足

市場予測通りの結果でしたが、

マーケットは意味不明の乱高下。

売り買いの力が拮抗していることを表しています。

今晩はBOE,ECB金利、

そして明日は米雇用統計。

どんな乱高下が見られるのか楽しみです。

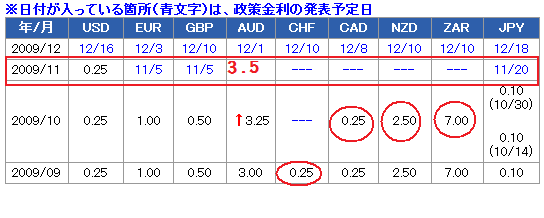

※各国政策金利一覧

データ by セントラル短資