FOMC声明 日本時間 2015/07/30 (木) 03:00ごろ発表

Press Release

Release Date: July 29, 2015

For immediate release

Information received since the Federal Open Market Committee met in June indicates that economic activity has been expanding moderately in recent months. Growth in household spending has been moderate and the housing sector has shown additional improvement; however, business fixed investment and net exports stayed soft. The labor market continued to improve, with solid job gains and declining unemployment. On balance, a range of labor market indicators suggests that underutilization of labor resources has diminished since early this year. Inflation continued to run below the Committee's longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports. Market-based measures of inflation compensation remain low; survey‑based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of earlier declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.(反対無し)

FRB: Press Release--Federal Reserve issues FOMC statement--July 29, 2015

http://www.federalreserve.gov/newsevents/press/monetary/20150729a.htm

今回はイエレン会見無し

今回のFOMCでも、金利自体はゼロ金利据え置きとなりました。

問題は、いつゼロ金利解除するのか、利上げに踏み切るのか、です。

この点、FOMC声明を読むと、

エネルギー価格の下落にもかかわらず、

目線はあくまでも利上げ方向にあるようです。

経済ボロボロで大規模な量的緩和に踏み切った欧州とは対照的に、

米経済は底堅く回復基調にあるようです。

以前のようなイケイケムードからは若干後退したようにも思えますが、

経済ボロボロで、貨幣をジャブジャブ刷って刷って刷りまくりの欧州、日本と比較すると、

あくまでも米国一人勝ちの構図は変わっていません。

ファンダメンタル分析的に考えれば、

FOMC声明で乱高下するも、

じわりとドル高になる

と考えるのが自然です。

少なくとも、ドル安になる材料ではありません。

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは14:00が日本時間03:00

純然たるドル高

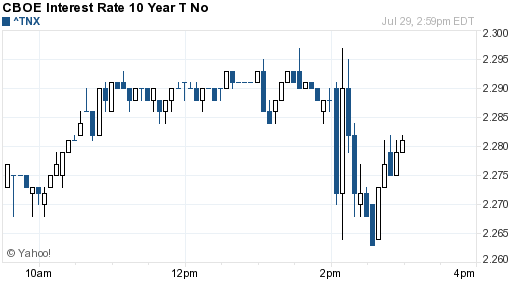

米長期金利(米国債10年物流通利回り) →乱高下

→ http://fxtechnicalblog.fxtec.info/2006/12/saxo_1.html

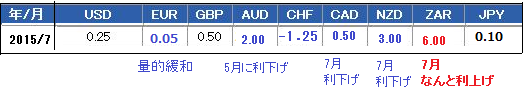

各国政策金利一覧