FOMC声明 日本時間 2014/3/20 (木) 03:00ごろ発表

Press Release

Release Date: March 19, 2014

For immediate release

Information received since the Federal Open Market Committee met in January indicates that growth in economic activity slowed during the winter months, in part reflecting adverse weather conditions. Labor market indicators were mixed but on balance showed further improvement. The unemployment rate, however, remains elevated. Household spending and business fixed investment continued to advance, while the recovery in the housing sector remained slow. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace and labor market conditions will continue to improve gradually, moving toward those the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for the economy and the labor market as nearly balanced. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

The Committee currently judges that there is sufficient underlying strength in the broader economy to support ongoing improvement in labor market conditions. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions since the inception of the current asset purchase program, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in April, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $25 billion per month rather than $30 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $30 billion per month rather than $35 billion per month. (今月も100億ドル縮小!!前回650億ドル→550億ドルに縮小)The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy remains appropriate. In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. (失業率6.5%の基準を撤廃) This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

With the unemployment rate nearing 6-1/2 percent, the Committee has updated its forward guidance. The change in the Committee's guidance does not indicate any change in the Committee's policy intentions as set forth in its recent statements.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Richard W. Fisher; Sandra Pianalto; Charles I. Plosser; Jerome H. Powell; Jeremy C. Stein; and Daniel K. Tarullo.

Voting against the action was Narayana Kocherlakota, who supported the sixth paragraph, but believed the fifth paragraph weakens the credibility of the Committee's commitment to return inflation to the 2 percent target from below and fosters policy uncertainty that hinders economic activity.

http://www.federalreserve.gov/newsevents/press/monetary/20140319a.htm

3:30頃~ イエレン会見

「ガイダンス変更は政策意図の変更ではない。」

「最近の軟調な指標にかかわらず、継続的な進展ある見通し。」

「労働市場は改善が続いている。」

「金融環境はFOMCの目標に沿っている。」

「とりわけ天候により、経済の力強い判断が困難になった。」

「FOMCのインフレ予想は徐々に2%に向かっている。」

「FOMCの政策は2つの責務に沿っている。」

「量的緩和、事前に決められたコースはない。」

「量的緩和の今後は経済次第だとあらためて表明。」

「雇用・インフレの不足が拡大し期間が長引くほど、FF金利がゼロ%近辺に留まる期間が長くなる可能性。」

「非常に緩和的な政策、必要だと改めて表明。」

「多くの参加者、金融危機の残存する影響と金利見通しの潜在的な伸び鈍化を指摘。」

「インフレが目標を大幅に下回り失業率が高い中で、非常に緩和的な政策が必要。」

「ガイダンスは質的なものになる。」

「完全雇用の達成、近くない。」

「量的緩和の終了は今秋の可能性高いとあらためて表明。」

「労働市場指標を1つ選ぶ場合、失業率が最善の選択。」

「新たなガイダンス、質的情報などこれまでより一段の情報を提供すること目的。」

「インフレが下振れする深刻な懸念あれば、われわれは回避に向け行動すると確信。」

「正常金利への道は緩やかなものになる可能性も。」

「天候は第1四半期の経済を弱めた。」

前回のFOMCとの変更点は、QE3実施規模をさらに縮小。

昨年12月まで、毎月850億ドルの流動性供給(ドルをジャブジャブに刷りまくり)

→昨年12月のFOMCで750億ドルへ縮小、

→さらに1月のFOMCで650億ドルへ縮小

→さらに今回、550億ドルへ縮小。

毎月100億ドル、約1兆円の流動性供給低下です。

昨年12月に比べると、毎月ベースで約3兆円の流動性供給低下です。

思ったよりも早いペースで蛇口を絞っています。

イエレンは、今年の秋にQE3は終了すると言っているので、

おそらくこのペースで毎月100億ドルの縮小が続いていくのでしょう。

ドルをジャブジャブにする(=希薄化)ペースを緩める、ということで、

ファンダメンタル的にはドル高材料です。

逆に、株式市場的には株安材料です。

金利については、金利自体は変更無し。

注目すべき点としては、失業率6.5%の基準が消去されていますが、

長期的な物価目標が2%に達しない場合、経済環境の情況によっては、

利上げしない、

というような内容の文が入っています。

当分ゼロ金利維持するから安心してね!金利は上げないよ!という株式市場(&米国債市場)へのメッセージと思われます。

QE3縮小で株暴落&景気減速懸念が出ることとのバランスを取った形です。

(通貨的にはドル安方向の材料)

ファンダメンタル分析的に考えれば、

・QE3縮小→ドル高、株安

・低金利堅持アピール→ドル安、株高

であり、

単純にどちらか一方通行になるような、単純な材料ではありません。

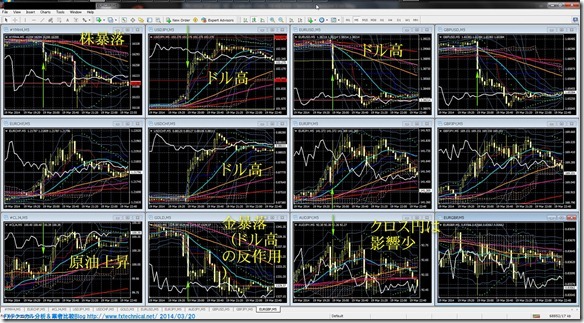

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは20:00が日本時間03:00

米長期金利(米国債10年物流通利回り)→爆上げ

→ http://fxtechnicalblog.fxtec.info/2006/12/saxo_1.html

各国政策金利一覧