FOMC声明 日本時間 2013/9/19 (木) 03:00ごろ発表

Press Release

Release Date: September 18, 2013

For immediate release

Information received since the Federal Open Market Committee met in July suggests that economic activity has been expanding at a moderate pace. Some indicators of labor market conditions have shown further improvement in recent months, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has been strengthening, but mortgage rates have risen further and fiscal policy is restraining economic growth. Apart from fluctuations due to changes in energy prices, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will pick up from its recent pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished, on net, since last fall, but the tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and labor market. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term.

Taking into account the extent of federal fiscal retrenchment, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program a year ago as consistent with growing underlying strength in the broader economy. However, the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases. Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. (QE3規模は維持) The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. In judging when to moderate the pace of asset purchases, the Committee will, at its coming meetings, assess whether incoming information continues to support the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective. Asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's economic outlook as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.(特に変更無し) In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Charles L. Evans; Jerome H. Powell; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.(いつものおじちゃんが反対)

FRB: Press Release--Federal Reserve issues FOMC statement--September 18, 2013

http://www.federalreserve.gov/newsevents/press/monetary/20130918a.htm

3:30頃から バーナンキ会見

「失業率は許容範囲より高い。」

「下振れリスクは緩和。」

「財政状況が成長を1%超押し下げている。」

「雇用状況は望ましい状況からかけ離れている。しかし、前進は見られる。」

「少なくとも失業率が6.5%までは現在の低金利が適切。」

「失業率が6.5%を相当程度下回るまで利上げはない公算。」

「資産購入にはあらかじめ定まった道筋ない。」

「見通しに確信が持てれば、年内に資産購入縮小も。この先は経済状況次第。」

「任期の3期目については話したくはない。」

「FOMCには予定外の記者会見という選択肢がある。」

「金利は2016年以降段階的に上昇し、将来的には4%に達する可能性。」

市場予想どおりの実質ゼロ金利据え置き、

QE3実施規模の据え置き、

「異例の低金利」の具体的な解除条件据え置き、

と、ほぼ完全に前回の内容を踏襲する結果となりました。

ファンダメンタル分析的に考えれば、

材料織り込み済みで動きようがない、

となるように思えます。

これを受けてマーケットはどのように反応したのでしょうか。

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは21:00が日本時間03:00

株爆上げ、ドル爆安となりました。

純粋なドル安で、円安にはなりませんでした。

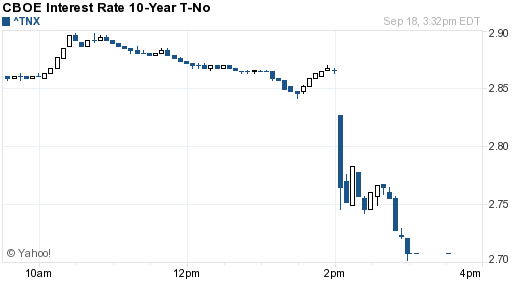

その理由の一つとして、米長期金利が狂ったように下げたことがあると思われます。

→ http://fxtechnicalblog.fxtec.info/2006/12/saxo_1.html

猛烈な爆下げです。

利上げ期待が一気にしぼんだ感じです。

当たり前ですが、ドル円相場に米長期金利が深く関わっているということがよくわかります。

さて、今回の下げでもドル円は雲でがっちりサポートされましたが、

米長期金利の投げられっぷりを見ると、嵐の予感もします。

注意が必要です。

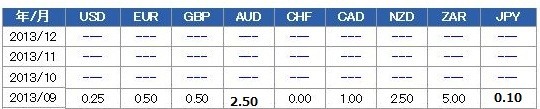

政策金利一覧