日本時間2011/04/28 01:30発表

Release Date: April 27, 2011

For immediate release

Information received since the Federal Open Market Committee met in March indicates that the economic recovery is proceeding at a moderate pace and overall conditions in the labor market are improving gradually. Household spending and business investment in equipment and software continue to expand. However, investment in nonresidential structures is still weak, and the housing sector continues to be depressed. Commodity prices have risen significantly since last summer, and concerns about global supplies of crude oil have contributed to a further increase in oil prices since the Committee met in March. Inflation has picked up in recent months, but longer-term inflation expectations have remained stable and measures of underlying inflation are still subdued.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The unemployment rate remains elevated, and measures of underlying inflation continue to be somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Increases in the prices of energy and other commodities have pushed up inflation in recent months. The Committee expects these effects to be transitory, but it will pay close attention to the evolution of inflation and inflation expectations. The Committee continues to anticipate a gradual return to higher levels of resource utilization in a context of price stability.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. In particular, the Committee is maintaining its existing policy of reinvesting principal payments from its securities holdings and will complete purchases of $600 billion of longer-term Treasury securities by the end of the current quarter. The Committee will regularly review the size and composition of its securities holdings in light of incoming information and is prepared to adjust those holdings as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.

FRB: Press Release--FOMC statement--April 27, 2011

http://www.federalreserve.gov/newsevents/press/monetary/20110427a.htm

日本時間2011/04/28 03:15ごろ

FRB議長 バーナンキ会見

「連邦準備制度は保有証券を必要に応じて調整する。」

「2011年を通じて緩やかな回復持続すると予測。」

「FOMCは大幅な緩和策を維持。」

「第1四半期の成長は比較的弱い。」

「ただ、弱い要因の多くは一時的」

「行動の前に数回の会合。」

「強いドルは米国、世界にとって利益。」

「いつ引締めに転じるかはわからない。」

「ガソリン価格上昇は困難をもたらす。」

「ガソリン価格上昇によるインフレは緩和する。」

「現在のようなペースでの上昇は続かない。」

「労働市場の回復ペースは緩やか。」

「中期的なインフレ期待は大きく上昇していない。」

「原油需要の拡大、基本的にすべて新興国によるもの。」

「再投資を止めることは引締めと同様。」

「資産保有額は一定の水準に維持。」

「ガソリン価格高への対処、FRBにできること少ない。」

「QE2は万能薬ではなかったが、米経済を良い方向に導いた。」

「金融緩和政策の規模、6月以降引き続き一定。」

「日銀は、資金供給などよい対応をしている。」

「日本の大震災の主な影響はサプライチェーンを通じてのもの。」

「金融状況の緩和、ボラティリティー低下、株高が確認できた。」

市場予想どおりの実質ゼロ金利据え置きでした。

また、従来通り、「長期間に渡って政策金利を異例の低水準で据え置く」の文言がしっかりと明記されました。

(continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.)

何のサプライズもありません。

その後のバーナンキ会見も特にサプライズもありませんでした。

常識的、ファンダメンタル分析的に考えると、

織り込み済みとなって動きようがないようにも思えます。

では、この材料を受けて、机上の空論ならぬ現実のマーケットはどのように動いたのでしょうか?

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

5分足 以下のチャートでは18:30が日本時間01:30

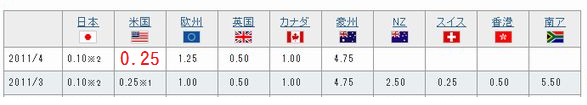

※各国政策金利一覧

データ by 外為どっとコム