Press Release

Release Date: August 10, 2010

For immediate release

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

Measures of underlying inflation have trended lower in recent quarters and, with substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal Reserve's holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal Reserve's holdings of Treasury securities as they mature.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh.

Voting against the policy was Thomas M. Hoenig, who judges that the economy is recovering modestly, as projected. Accordingly, he believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted and limits the Committee's ability to adjust policy when needed. In addition, given economic and financial conditions(ホーニング氏反対意見), Mr. Hoenig did not believe that keeping constant the size of the Federal Reserve's holdings of longer-term securities at their current level was required to support a return to the Committee's policy objectives.

FRB: Press Release--FOMC statement --August 10, 2010

http://www.federalreserve.gov/newsevents/press/monetary/20100810a.htm

市場予想どおりの実質ゼロ金利据え置きでした。

また、従来通り、「長期間に渡って政策金利を異例の低水準で据え置く」の文言がしっかりと明記されました。

(continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.)

何のサプライズもありません。

常識的、ファンダメンタル分析的に考えると、

織り込み済みとなって動きようがないようにも思えます。

では、この材料を受けて、机上の空論ならぬ現実のマーケットはどのように動いたのでしょうか?

↓のチャートを見る前に1分間想像してみてください。

・NYダウ の値動き → 上昇?下落?

・ドル円 の値動き → 上昇?下落?

・ユーロドル の値動き → 上昇?下落?

・ユーロ円 の値動き → 上昇?下落?

・ポンドドル の値動き → 上昇?下落?

・ポンド円 の値動き → 上昇?下落?

・原油 の値動き → 上昇?下落?

・金 の値動き → 上昇?下落?

1分足 以下のチャートでは20:15が日本時間3:15 全く「材料織り込み済み」ではありませんでした

5分足 純然たるドル安

純然たるドル安で反応しました。

今の地合いがそのまま出ている模様です。

奇妙なのが、NYダウと、ドル円・クロス円がシンクロしていない点。

「何か」が水面下で動いているのかもしれません。

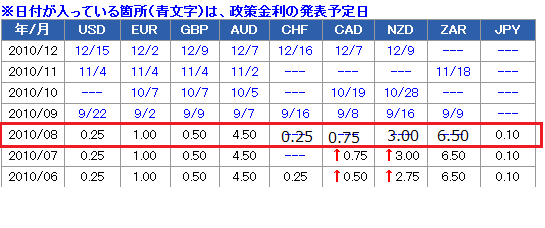

※各国政策金利一覧

データ by セントラル短資