Release Date: January 27, 2010

For immediate release

Information received since the Federal Open Market Committee met in December suggests that economic activity has continued to strengthen and that the deterioration in the labor market is abating. Household spending is expanding at a moderate rate but remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software appears to be picking up, but investment in structures is still contracting and employers remain reluctant to add to payrolls. Firms have brought inventory stocks into better alignment with sales. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.

With substantial resource slack continuing to restrain cost pressures and with longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter. The Committee will continue to evaluate its purchases of securities in light of the evolving economic outlook and conditions in financial markets.

In light of improved functioning of financial markets, the Federal Reserve will be closing the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility on February 1, as previously announced. In addition, the temporary liquidity swap arrangements between the Federal Reserve and other central banks will expire on February 1. The Federal Reserve is in the process of winding down its Term Auction Facility: $50 billion in 28-day credit will be offered on February 8 and $25 billion in 28-day credit will be offered at the final auction on March 8. The anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30 for loans backed by new-issue commercial mortgage-backed securities and March 31 for loans backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that economic and financial conditions had changed sufficiently that the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted.

FRB: Press Release--FOMC statement--January 27, 2010

http://www.federalreserve.gov/newsevents/press/monetary/20100127a.htm

市場予想どおりの実質ゼロ金利据え置きでした。

何のサプライズもありません。

また、長期間低金利が継続されるだろうという文言も、従来と変わらず入っています。

何のサプライズもありません。

では、机上の空論ならぬ、現実のマーケットはどのように反応したのでしょうか。

以下のチャートを見る前に1分間、値動きを想像してみてください。

・NYダウ

・ドル円

・ユーロドル

・ユーロ円

・原油

・金

1分足 以下のチャートでは20:15が日本時間4:15

原因不明のドル高

ダウ爆上げと完璧に連動してクロス円もいきなり高騰

5分足

市場予想通りの金利据え置きだったわけですが、

材料織り込み済みとはならず

マーケットはNYダウ暴騰

ドル高騰

で反応しました。

どさくさに紛れてユーロドルでは投機筋が大暴れして

1.4割れの攻防がありましたが、

結局下方ブレイクは阻止されてしまいました。

今回の乱高下は、ユーロドル1.4の攻防が、

他通貨、特にドル円とユーロ円に影響を及ぼしたものと推察します。

さて、その後もユーロドルは1.4ちょっと上で滞空しており、

1.4ブレイクをまだ諦めていいない様子。

このブレイクはドル円、クロス円に大きな影響を与えますので、

注意が必要です。

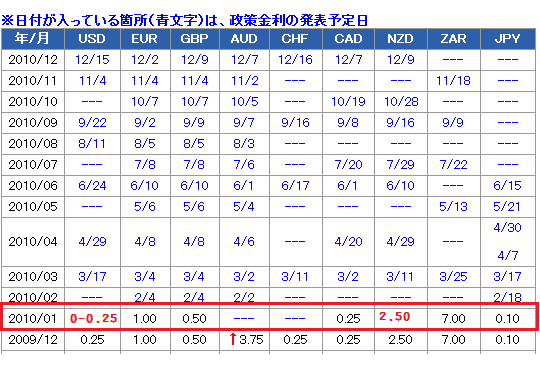

※各国政策金利一覧

データ by セントラル短資