Release Date: October 31, 2007

For immediate release

The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/2 percent.

(市場予想どおり 0.25%利下げ、4.5%、日米金利差縮小、全くサプライズではない)

Economic growth was solid in the third quarter, and strains in financial markets have eased somewhat on balance. However, the pace of economic expansion will likely slow in the near term, partly reflecting the intensification of the housing correction. Today’s action, combined with the policy action taken in September, should help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and promote moderate growth over time.

Readings on core inflation have improved modestly this year, but recent increases in energy and commodity prices, among other factors, may put renewed upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

The Committee judges that, after this action, the upside risks to inflation roughly balance the downside risks to growth. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Donald L. Kohn; Randall S. Kroszner;

Frederic S. Mishkin; William Poole; Eric S. Rosengren; and Kevin M. Warsh.

Voting against was Thomas M. Hoenig, who preferred no change in the federal funds rate at this meeting.

(一名の反対)

In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 5 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Richmond, Atlanta, Chicago, St. Louis, and San Francisco.

(公定歩合も5%に利下げ)

FRB: Press Release--FOMC statement--October 31, 2007

http://www.federalreserve.gov/newsevents/press/monetary/20071031a.htm

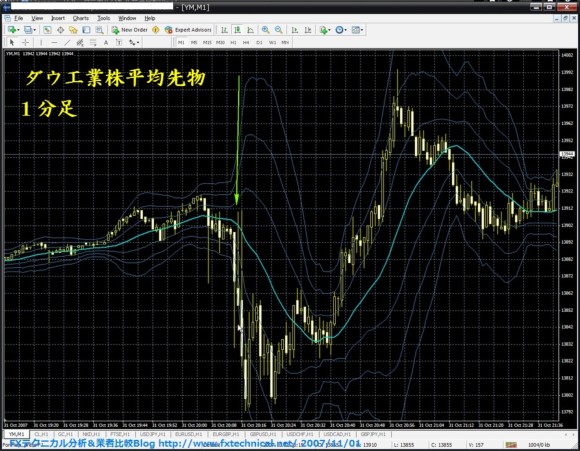

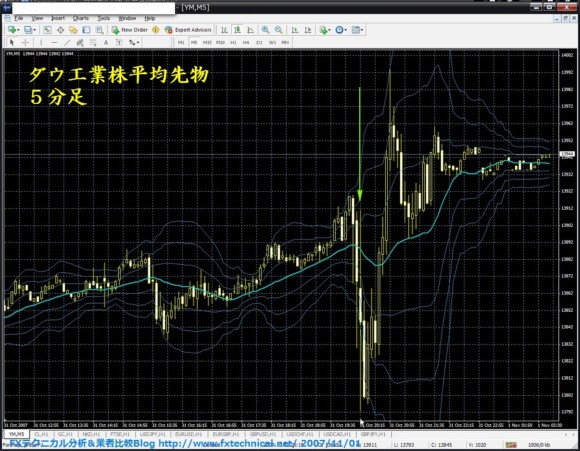

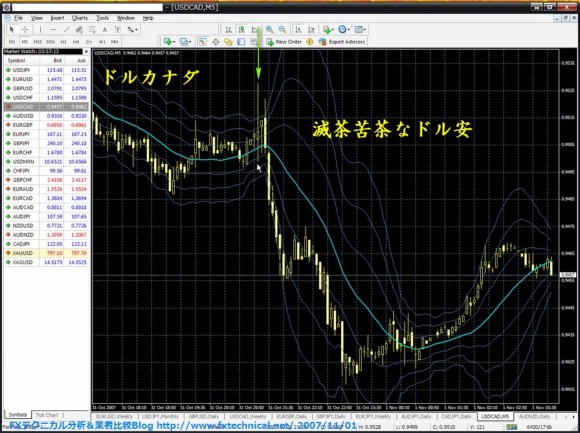

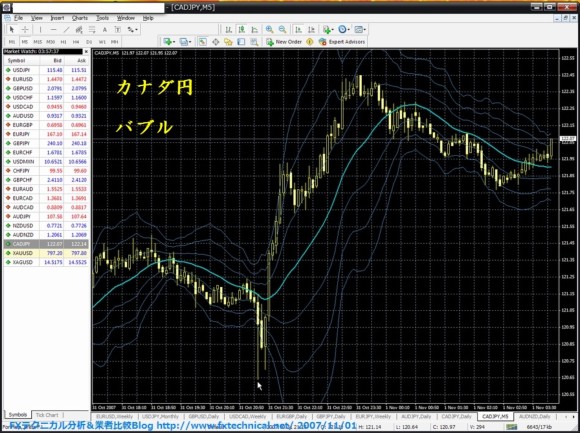

最初から分かり切った予想通りの結果に、

マーケットはどのように反応したのでしょうか。

・株高、

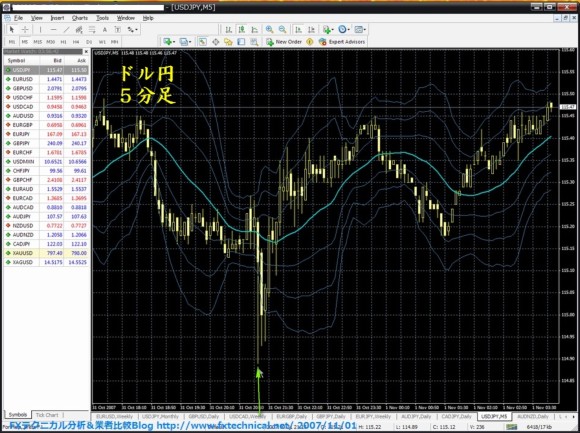

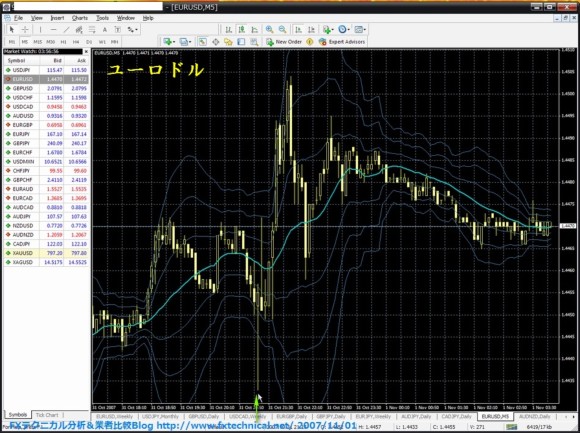

・ドル安、

・円安、

・クロス円高

という、例のバブル黄金パターンでした。

FOMC直後に、

ダウ急落と連動してユーロドルも急落(=ドル高)しているのが

非常に興味深いです。

空前のドル安、円安、クロス円高 バブル相場ですが、

このドル安、クロス円高 バブルも、

ダウ崩壊と運命をともにしているということです。