For immediate release

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth has slowed over the course of the year, partly reflecting a substantial cooling of the housing market. Although recent indicators have been mixed, the economy seems likely to expand at a moderate pace on balance over coming quarters.

Readings on core inflation have been elevated, and the high level of resource utilization has the potential to sustain inflation pressures. However, inflation pressures seem likely to moderate over time, reflecting reduced impetus from energy prices, contained inflation expectations, and the cumulative effects of monetary policy actions and other factors restraining aggregate demand.

Nonetheless, the Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Voting for the FOMC monetary policy action were: Ben S.

Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Susan S.

Bies; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin;

Sandra Pianalto; William Poole; Kevin M. Warsh; and Janet L.

Yellen. Voting against was Jeffrey M. Lacker, who preferred an

increase of 25 basis points in the federal funds rate target at

this meeting.

FRB: Press Release--FOMC statement--December 12, 2006

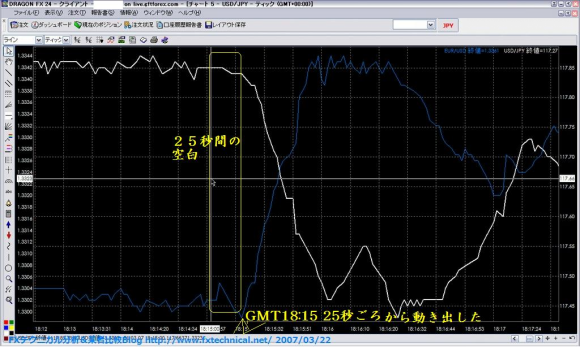

早朝のFOMC相場は、一言で言うと、ドル安かつ円安でした。

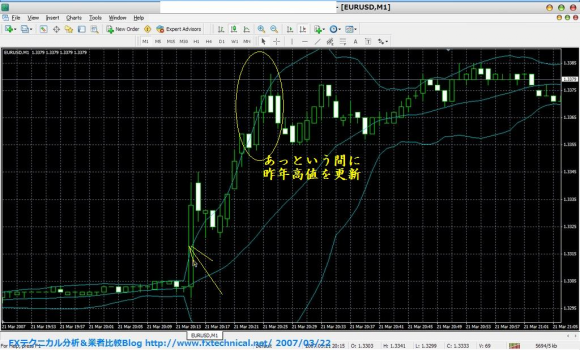

ユーロドルは、かなり堅いはずの昨年高値1.3366を、軽~く上方ブレイクしました。

史上最高値1.3665をトライする流れの模様。

先々週の雇用統計の意味不明な爆下げでユーロドル買ポジを投げたのが悔やまれます・・・。(←しつこい)

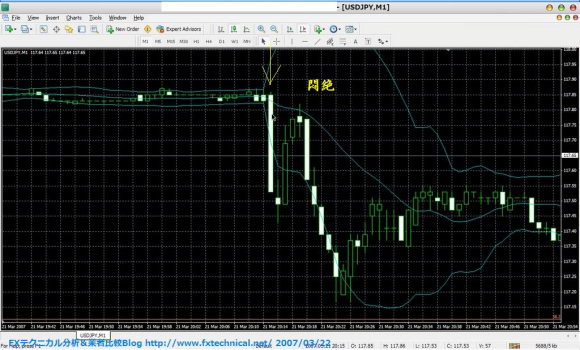

ドル円117.41買いポジですが、私のモデルではまだ反転サインが出てないのでしつこく持っています。

ユーロドルが上方ブレイクしたのにドル円が下降反転してないのが気持ち悪いのですが、

とりあえずテクニカル分析で示現している上昇サインを信じて、気合いでアホールドしてみます。